capital gains tax canada calculator

Its taxed at your marginal tax rate just like any other income. The tax calculator is updated yearly once the federal government has released the years income tax rates.

Capital Gains Tax Calculator For Relative Value Investing

High net worth individuals and investors may need to consider the implications of capital gains tax on their personal finances and individual wealth management.

. Note When calculating the capital gain or loss on the sale of capital property that was made in a. To calculate your capital gain or loss subtract the total of your propertys ACB and any outlays and expenses incurred to sell your property from the proceeds of disposition. The tax rate on short-term capitals gains ie from the sale of assets held for less than one year is the same as the rate you pay on wages and other ordinary income.

Since your property is in Canada 50 of the total capital gains profit is subject to tax. Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. It will also help you estimate the financial value of deferring those taxable gains through a 1031 like-kind exchange Starker exchange instead of a taxable sale.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. How Much Capital Gains Tax Do You Pay On Property. How is crypto tax calculated in Canada.

Capital Gains Tax Calculator Real Estate 1031 Exchange. Those rates currently range from. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year.

50 of your Capital Gain is taxable minus any offsetting capital losses. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. This capital gains calculator estimates the tax impact of selling your show more instructions.

Capital Gains Taxes on Property. Below are the federal tax brackets for 2022 which can give you. For instance if you sell a property and make 100000 in profit the capital gains tax rate will only apply to 50000.

Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. Capital Gains Tax Calculator. 250000 100000 150000 total capital gains Since your property is in Canada 50 of the total capital gains profit is subject to tax.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Capital gains tax calculator for Canada So how do you calculate how much tax you owe on your capital gains. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income.

The amount of tax youll pay depends on how much youre earning from other sources. Each capital gains calculator includes personal tax allowances tax deductions etc and provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly pay illustrations. Capital gains x 50 Inclusion rate x Your personal tax rate Capital gains owed.

Gains between 350k and 250k 100000 in capital gain. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223. Capital gains are taxed as part of your income on your personal tax return.

Those rates currently range from 10 to 37 depending on your taxable income. 150000 x 50 75000. The calculator will show your tax savings when you vary your RRSP contribution amount.

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. Taxation of capital gains is based on 1 The proceeds from disposed units 2 The cost base included in these units 3 The Expenses on disposed unitsUsing this equation you can determine how much your income tax and benefit return is attributable to capital gains that are taxable multiply the. How to calculate capital gains tax is.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Capital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services taxharmonized sales tax credit the Canada child benefit credits allowed under certain related provincial or territorial programs and the age amount. Our free tool allows you to check your capital gains tax.

You will then be taxed at the standard rate based on your type of investment and your marginal income tax rate. Because in Canada only 50 percent of capital gains are taxable 100000 50000 as only half of these gains qualify for tax. Now if the property is under your personal name the 75000 is added to your overall income.

Therefore 150000 x 50 75000 The total taxable amount for this property is 75000. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds.

A capital gain occurs when you sell or are considered to have sold a capital property for more than the total of its adjusted cost base and the expenses incurred in selling the property. A good capital gains calculator like ours takes both federal and state taxation into account. Canada Capital Gains Tax Calculator 2021 Table of contents Published 10122021 1512 EST Updated 01032022 1203 EST.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. 2020 Long-Term Capital Gains Tax Rate Income Thresholds. Capital gains tax rates on most assets held for less than a year correspond to.

Taxable Capital Gain Capital Gain x 50 Capital Losses Add your Taxable Capital Gain to your total income. In our example you would have to include 1325 2650 x 50 in your income. New Hampshire doesnt tax income but does tax dividends and interest.

In Canada 50 of the value of any capital gains is taxable. The total taxable amount for this property is. The basic formula for calculating capital gains is the following.

How Do You Calculate Capital Gains On Sale Of Property In Canada. And the tax rate depends on your income. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2022.

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

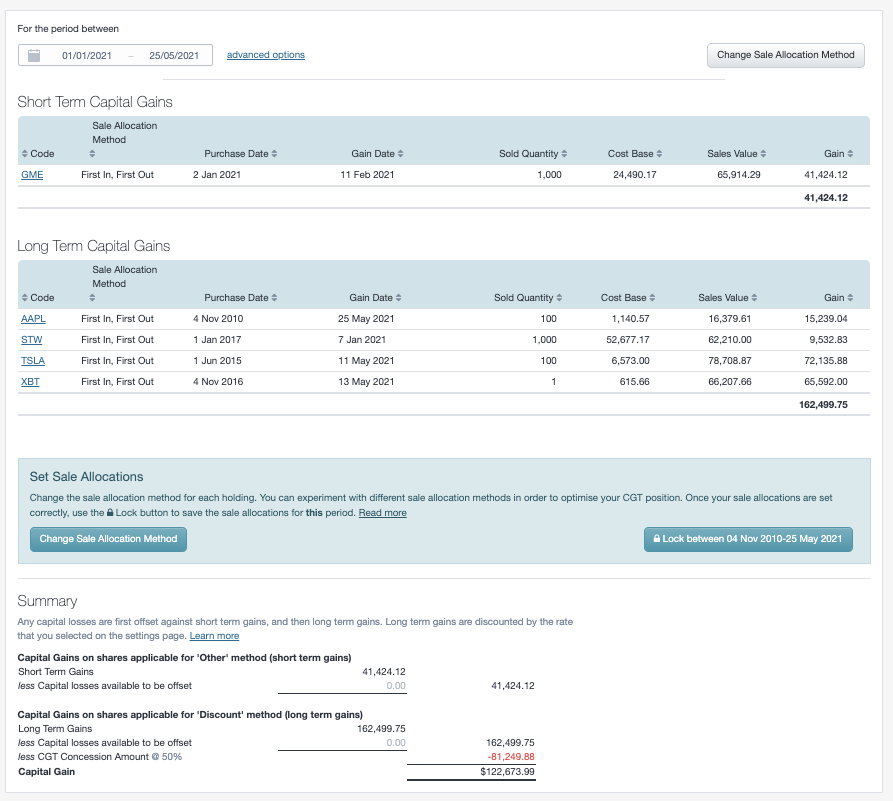

Canadian Capital Gains Tax Report Makes Tax Time Easy Sharesight

How Do I Report Capital Gains In British Columbia

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax Calculator For Relative Value Investing

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

Capital Gain Calculator Estimate The Tax Payable Scripbox

Capital Gains 101 How To Calculate Transactions In Foreign Currency

How To Compute Capital Gain Tax And Documentary Stamp Tax On Real Properties By J23tv Youtube

How Do I Calculate Capital Gains On The Sale Of My Home

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

.jpg)

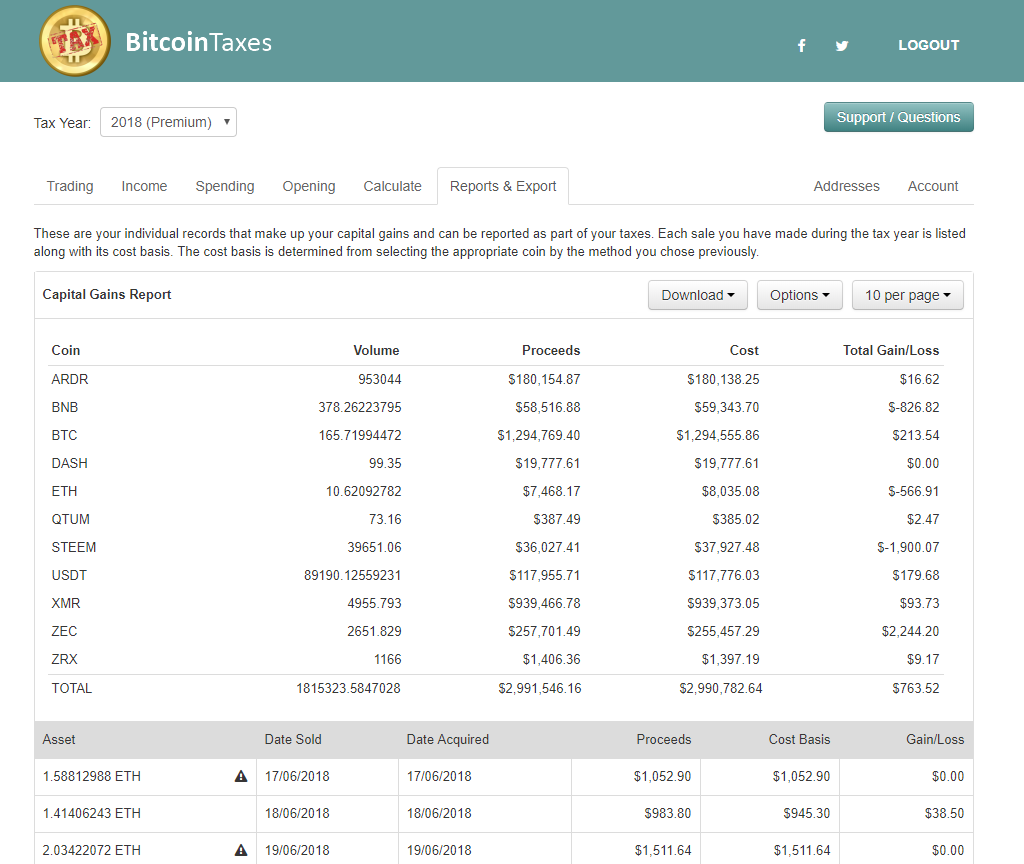

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe